Why Are Insurance Companies Turning to AI for Claims Processing?

Artificial Intelligence (AI) has unravelled the possibilities for growth in all industries. The insurance industry is not an exception. AI has transformed the insurance industry massively in all traditional insurance practices, particularly in claims processing.

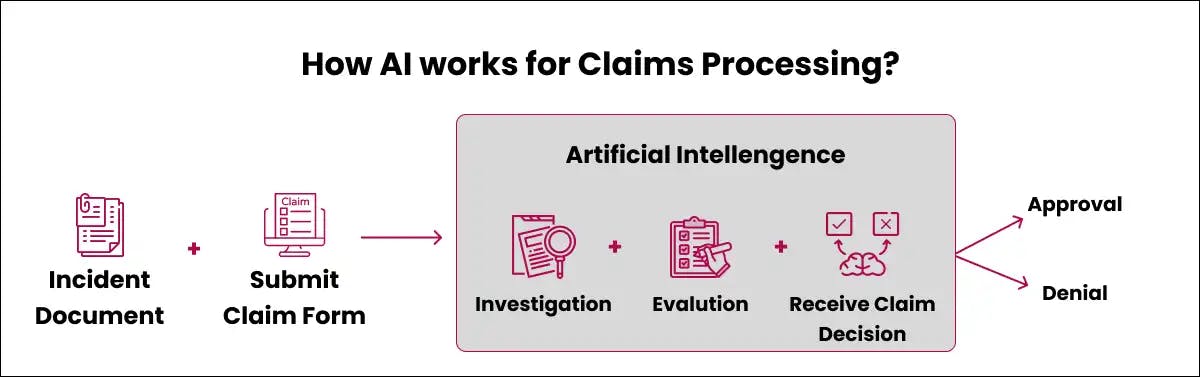

Here is a quick rundown on AI in insurance claims:

- AI helps to cut cost on claim resolution by around 75% and increase the claim cycle speed up to 5-10x times faster through automated intelligent processes.

- AI helps the insurance sector to increase its operational efficiency by 60% with 99.99% claim accuracy. [Source: Forbes]

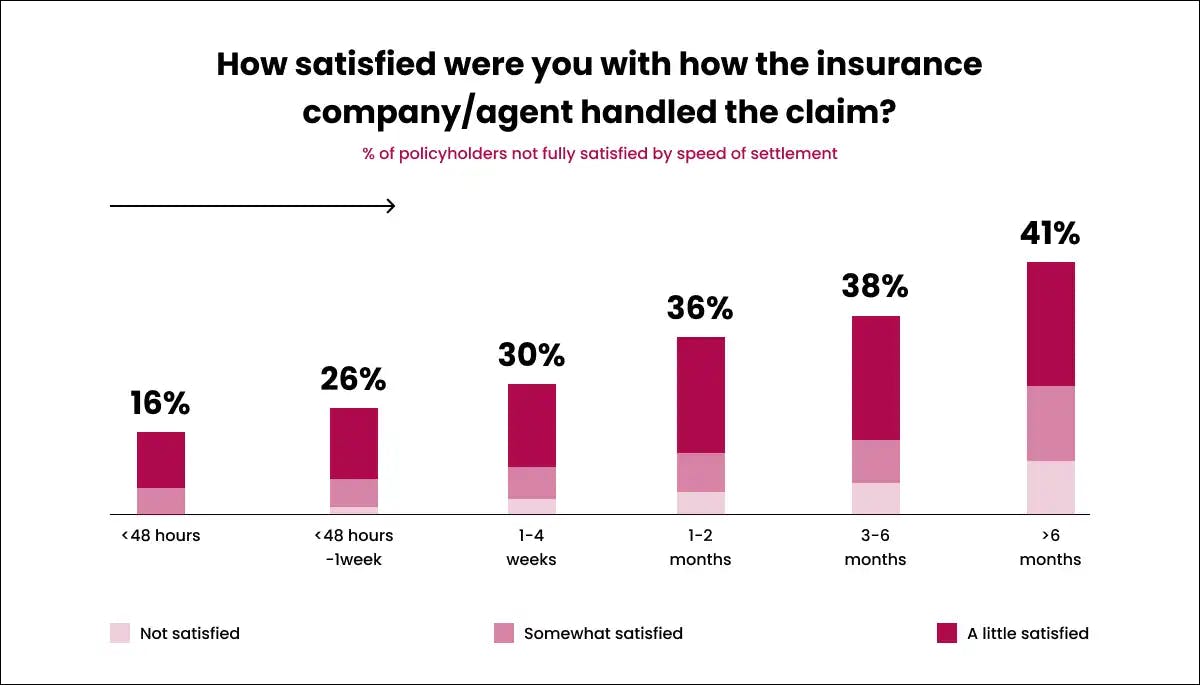

With such speed in the claim cycle and high claim accuracy, insurance companies will eventually gain better customer satisfaction rates. The below given pictorial view shows how insurance policyholders are satisfied when their claim gets it right.

The speed of claim settlement plays a major role in the satisfaction rate among the policyholders. This is why insurance companies prefer AI for their insurance claim processing.

Okay, let’s take a look at how AI solves the problems of traditional claim processing in brief.

Problem 1: Lengthy Claims Processing Times

What are the reasons behind the lengthy insurance claim process?

Traditional claims processing also known as paper-driven processes involves a lot of complexities making it cumbersome. It requires extensive human intervention to rectify errors leading to high administrative costs and delays in claim processing. Also, there would be no assurance of 100% error rectification in the manual handling of claims.

Solution: AI-Powered Claims Automation

AI-powered claim processing streamlines the process and delivers a hassle-free experience to both insurers and policyholders through automation. With the help of a centralised information-sharing system, AI helps insurers strike the right strike balance between paying the right claims promptly and detecting fraudulent ones.

The American-based strategy and management firm McKinsey predicts that in 2030 AI will play a vital role in insurance claim processing to meet the demands of policyholders and insurance companies.

The introduction of AI-powered Chatbots in claim registration will be the perfect example of how AI and ML speed up the claim process straightforwardly. It reduces the errors and incomplete data at registration itself and ensures all the essential documents aren’t missed by policyholders.

Problem 2: Lack of Transparency in Claims Status

When it comes to insurance claims, transparency is the major factor that establishes the trust between policyholders and insurance providers. However, in the point of policyholders, the claims handling process is always shrouded in mystery about their claim status and leaving them in the dark. For many policyholders this would be their million-dollar question:

Why am I always in the dark about my insurance claim status?

Well, the main reason would be the lack of transparency during the claims handling process and the communication gaps between policyholders and insurance providers. If the insurer manages to inform the progress of claims, policyholders will be aware of the potential outcomes and plan accordingly.

Solution: Real-Time Updates Through AI Integration

AI in the insurance industry helps insurers establish a transparent claims-handling process and have constant communication with policyholders by providing real-time updates through AI integration. An AI system automates the claim processing by giving clear and timely status updates to the policyholders. This paves the path for building trust and enhancing customer satisfaction.

Problem 3: Inaccurate Claims Assessments

Many insured people and insurers often wonder why some claim assessments are not accurate. Well, the presence of bias in the data will lead to inaccurate claims assessments or an inability to determine coverage.

What are the factors that lead to inaccurate assessments of insurance claims?

Bias in data may occur due to systematic errors or personal prejudices, and sometimes a different or the same professional makes different decisions for similar cases at different times.

Solution: Enhanced Accuracy with AI and Data Analytics

Such human errors in the traditional assessment processes can be handled effectively through the integration of an AI system in the insurance industry. AI systems, through their advanced data analysis, eliminate bias in data. It includes bias occurrence due to cognitive limitations, emotional influences, and other environmental factors.

Advanced data analysis of AI systems helps insurers process claim assessments fairly and quickly.

Problem 4: Fraudulent Claims and Their Impact on Genuine Claimants

Fraudulent claims will have a severe impact on genuine claimants in many ways like high premium costs and delays in claims settlement. If you wonder how fraudulent claims affect my claim processing, take a look.

How do fraudulent claims affect me?

Fraudulent claims result in an increase in premiums for honest customers due to the cost of investigating suspected fraud. Additionally, insurance companies are trying to strike a balance between investigating potential fraud and processing legitimate claims quickly and efficiently.

Solution: AI in Fraud Detection and Prevention

Insurance companies can introduce AI to solve the problem of fraudulent claims. Machine learning and AI algorithms identify the claim data patterns quickly and spot fraudulent or dubious requests in real time. This reduces the insurer's money a lot from spending on investigating fraudulent claims.

Problem 5: Impersonal Customer Service

Often, claimants experience impersonal customer service during traditional claim processing. It happens mainly because claim handling is a typical data-intensive process. If you are one of those who feel that talking to customer service feels so impersonal and unhelpful, well, here is the answer.

How do impersonal interactions with customer care representatives affect policyholder satisfaction?

In the traditional claims handling process, insurers may hire third-party call centres that will have certain limitations on accessing the claimant's information. This will delay claim acknowledgment and claim settlement process. Introducing personalised support with AI chatbots and virtual assistance will ease things for both insurers and policyholders.

Solution: Personalised Support with AI Chatbots and Virtual Assistants

AI systems in the insurance industry speed up the claims process by accessing the claimant’s information from a centralised information system. Also, it helps insurers retain honest policyholders by providing hyper-personalised insurance plans and knowledgeable support around the clock.

Conclusion

Having AI for claims processing helps insurance companies streamline and process claims settlements much faster at lower costs. The AI system extracts pertinent data about the claimant from the centralised information-sharing system through NLP - Natural Language Processing and image recognition. This enables insurers to speed up the claims process with increased efficiency. Want to know more about how AI in insurance works for claim processing? Let’s connect with our AI experts to discuss more about how to re-evaluate risk models, claims volume, pricing strategies, and more. At Codiste, our AI consultant also help the insurance industry to automate the entire process, from application submission to claim processing with no/zero human errors. This helps the insurance industry to save much cost and time as well and ultimately, it helps to serve customers with possible services.

AI in Customer Service: Trends & Predict...

Know more

A Deep Dive into How Agentic RAG Automat...

Know more

Is Agentic RAG Worth the Investment? Age...

Know more